Introduction

Tarana’s G1 technology brings ISPs a powerful tool for delivering high-speed broadband connectivity to subscribers who did not have this option before. At Preseem, we collect a lot of data from ISP access networks to help operators move from reactive to proactive operations and make their teams more efficient. Preseem monitors tens of thousands of Tarana devices across many ISPs, giving us unique insights into performance.

In this study, we’ve analyzed this large dataset to understand to what extent Tarana radios are delivering the plan rates of Internet subscribers being serviced by these radios. This is a follow-up to our previous article breaking down the typical and best-case link rates for Tarana radios in real deployments.

Data Analysis Method

A few key points about the methodology used in this study:

- The data used for this analysis comes from a variety of metrics extracted from Tarana radio systems. TCS does not currently display these link rate metrics, but they appear to be valid. In some cases, in particular with four carrier links, we have seen speed tests exceed the estimated link rate.

- Link rates fluctuate over time. For this analysis, we used the 50th percentile link rate over a 24-hour period to represent typical performance.

- To keep the focus clear, these results are based solely on downstream link rates. Upstream link rates are not addressed in this report.

Overall Results

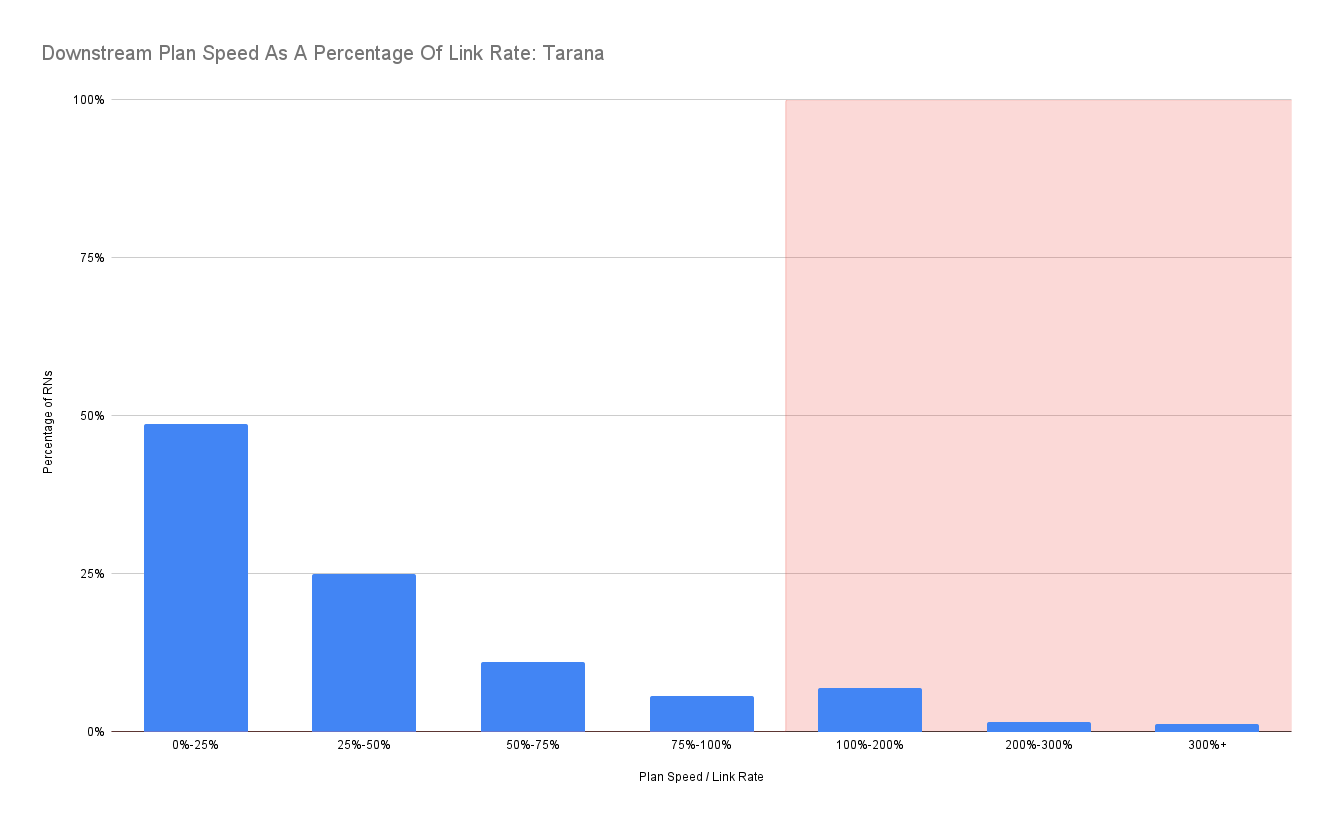

The chart below shows the results of analyzing the data across all Tarana radios.

This shows that just under 10% of services sold on Tarana radios cannot be achieved by the link. In other words, if you randomly sample a Tarana subscriber, there is a 1 in 10 chance that the subscriber will not achieve their link rate.

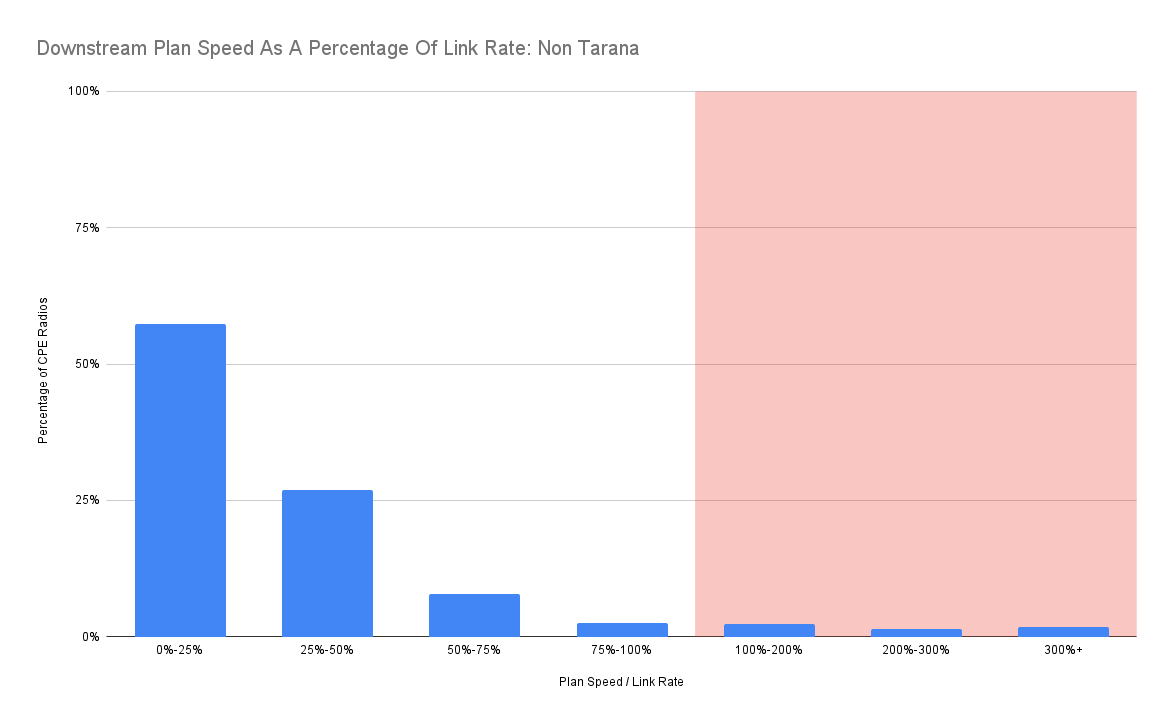

One obvious question from this is how this compares to traditional FWA equipment. The chart below presents those results.

The shape of the histogram for non-Tarana radios looks similar, but only about 5% of plans are unachievable.

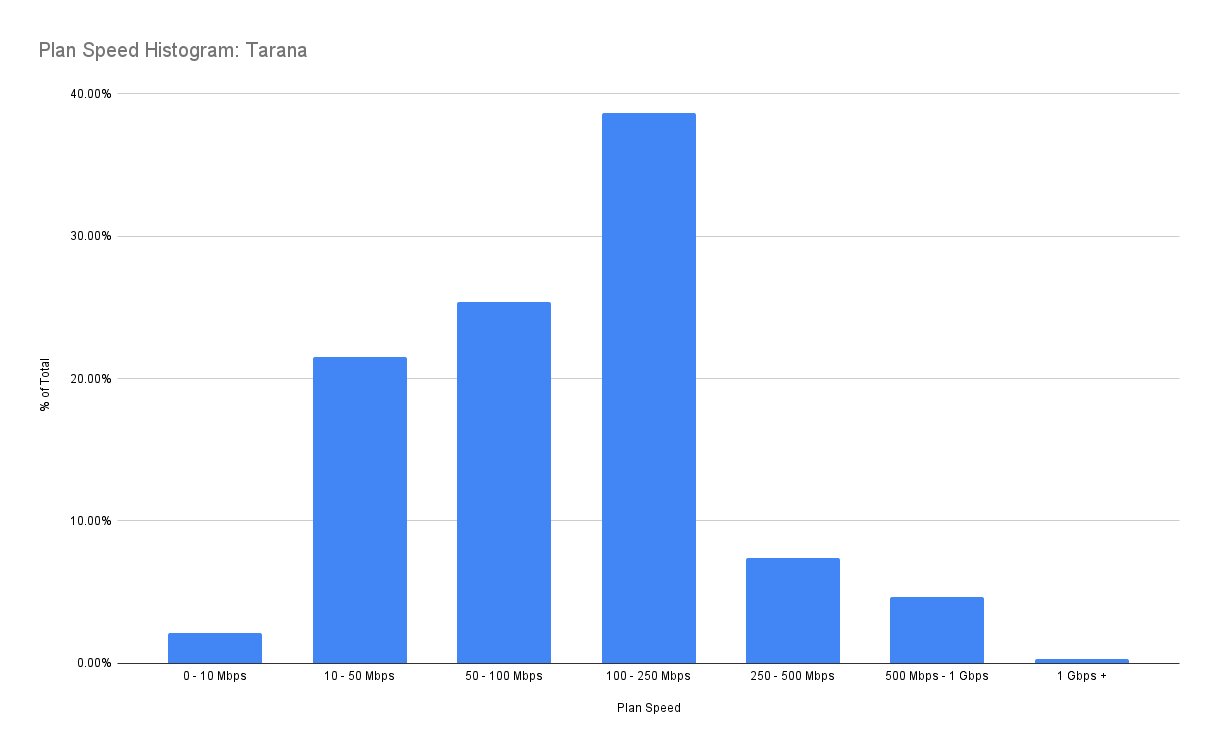

It may seem counterintuitive that deployments on a “next-generation” wireless platform are more likely to underachieve their plan speeds. However, the distribution of plan speeds will help explain why.

The charts below show plan speeds for Tarana and non-Tarana customers. The median plan speed for Tarana customers is 102 Mbps, and the median plan speed for non-Tarana customers is 26 Mbps.

Conclusions

From this observational study of Tarana link rates and plan speeds, we can draw the following conclusions:

1. Overall Performance:

- About 10% of service plans for Tarana customers cannot be consistently achieved by the links. This is almost twice as many as with traditional fixed wireless access.

2. Plan Speed Distribution:

- Most Tarana plans are over 100 Mbps downstream; with traditional fixed wireless access, only a small percentage of plans are sold at these speeds.

3. General Success Rate:

- Tarana’s technology delivers high-speed broadband to customers with a 90% success rate.

Unachievable Plan Speeds

What is causing plan speeds to exceed link rates? Here are a few examples of what we’ve seen in the data:

1. High Plan Speeds for Internal Use:

- In rare cases, plan speeds are set to a high value to allow the full link rate to be used. This is typically used for employees and installers.

2. Plan Speeds Near Link Rate Limits:

- Sometimes, plan speeds are set close to the top achievable link rate of the RN—for example, selling a 600 Mbps plan on the two-carrier G1 platform or a 1 Gbps plan on the four-carrier G1x2 platform. These speeds are achievable but require installs that meet strict guidelines, including low path loss values. Seasonal differences in foliage can reduce link rates over time.

3. Impact of Obstructions and Interference:

- Various conditions, such as obstructions and interference, can cause carriers to down-modulate to much lower modulations than would be possible in ideal conditions. While high path loss often indicates this, we have observed cases where interference from nearby radios caused issues even when path loss and other KPIs appeared normal.

4. CBRS Bandwidth Limitations:

- In CBRS deployments, RNs may not be able to allocate the full bandwidth due to other spectrum reservations.

Upgrade Opportunities

Many ISPs have subscribers with low-speed plans, such as 15 Mbps, on Tarana RNs capable of much higher rates. This presents an opportunity to increase customer satisfaction—and potentially ARPU—by offering speed upgrades to these subscribers. To target upgrades strategically:

- Use the BN’s RF Utilization to ensure sufficient airtime is available.

- Focus on subscribers with high link rates and modulation for minimal impact on the BN.

Future Directions

This data raises several questions that may guide future analyses:

- What are some of the reasons for low link rates, and what does this suggest for improved Tarana deployments?

- How is the BN affected by low link rates? Is there a correlation with high RF Utilization?

- What is the typical oversubscription ratio used on Tarana radios?

- How does Tarana compare to other modern FWA infrastructure such as Wi-Fi 6, and Wi-Fi 7 Access Points?

If you have other ideas for analyzing this data, we’d love to hear from you!