How Subscriber Data Usage is Trending at ISPs

Each year, Preseem issues the ISP Network Report, a free overview of the industry that’s full of exclusive data, analysis, and metrics for fixed wireless operators.

The information contained in the report provides ISPs with a useful way to benchmark their businesses against the wider broadband ecosystem. It also helps others understand fixed wireless networks and view new trends.

How do we get this information, you might reasonably ask? Good question! Preseem processes billions of metrics per day from ISPs across the US, Canada, and internationally. We then take this massive data pool and use it to provide an unbiased view of the fixed wireless industry across all service providers and vendors.

Topics covered in the ISP Network Report (formerly known as the Fixed Wireless Network Report) include subscriber data usage, access point metrics, RF channel width, oversubscription ratio, and lots more. For this blog, we’re going to focus on Subscriber Data Usage Metrics and Trends, though we’ll be issuing more blogs on the other topics in the near future so stay tuned for those.

Key subscriber data usage trends discussed below include (all figures year-over-year):

- Download throughput is up 9%

- Latency at peak time is down almost 9%

- Average download usage for fixed wireless subscribers is up 17%

- 23% of all subscribers use more than 16 GB per day

Download and Upload Throughput at Peak Time

In the Fixed Wireless Network Report, we distinguish between active subscribers (those actively using the internet) from connected subscribers. The latter simply refers to the number of radios or subscriber modules attached to an AP.

Also, many of the metrics in the report are taken at “peak time” or the internet rush hour, if you prefer. Our approach to determining this is to calculate the minutes in the day with the highest demand (not just throughput) and use those metrics to show true network performance.

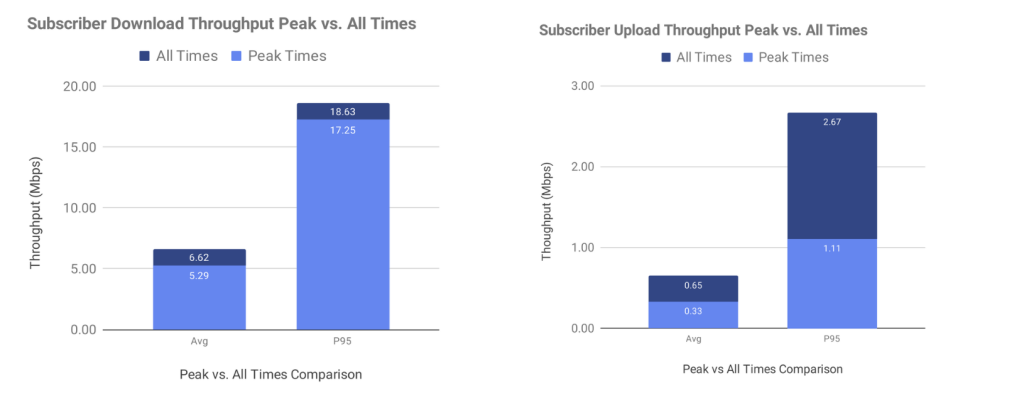

When it comes to download throughput, we found that the difference between peak time and other times of the day is actually pretty small. This indicates that, on the whole, subscriber throughput does not degrade significantly during busier times. We also found that subscriber download throughput for all times has risen 9% year over year. Nice job, ISPs! 🥳

As for upload throughput, the numbers are a little more confusing because most subscribers don’t stress the upload direction of their connection.

The per-subscriber upload rates show a larger difference in the ratio between peak and off-peak, indicating that networks may be more congested in the upstream during peak than normally assumed.

While subscribers care most about download performance, a congested upload path can cause download throughput problems because of TCP acknowledgment starvation. Similarly, a congested upload path can cause packet loss, which is also bad for subscriber QoE.

Latency Trends

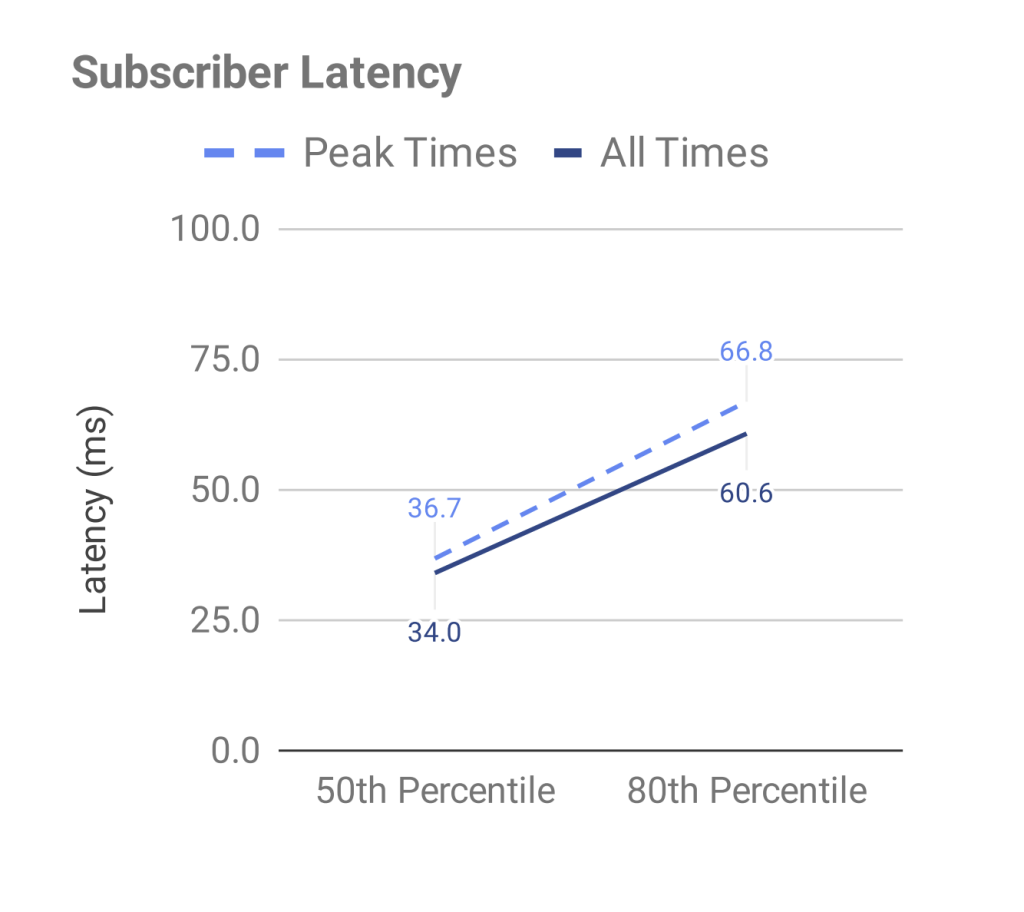

Preseem measures latency by tracking the round trip time for individual TCP segments. This gives us a detailed view of the latency in the access network and results in thousands of latency samples per second per subscriber.

Somewhat surprisingly, the latency difference between peak and off-peak times is relatively small. We should note that these metrics are collected from networks where Preseem is deployed to optimize latency and the subscriber experience. It’s likely that the latency in networks without such optimization is significantly higher. More good news for ISPs: peak latency has dropped nearly 9% year over year 🙌

Subscriber Data Usage

In Preseem terms, subscriber data usage refers to the total number of bytes transferred by a subscriber over a day or month.

The average download usage for fixed wireless subscribers is 12.46 GB per day (a 17% increase year-over-year) or 386 GB per month. As you might expect, the average hides the significant variation that occurs between subscribers. We’ve found that the balance is trending toward heavier users. Here, we see that 27% of subscribers use less than 1 GB of download usage per day. Meanwhile, 23% use more than 16 GB per day (half a TB per month), a 3% increase from the previous year.

Subscriber Data Usage by Speed Plan

In the previous chart, we refer to the “average” user. This doesn’t present the whole picture of user behavior, however. By breaking down subscriber usage by speed plan, we can see the relationship between plan and total data consumed. In all cases, there’s a large gap between the median user and users in higher percentiles.

In fact, the median user doesn’t really use more data as the speed plan increases. At the 80th percentile and above, we do see a steady increase, but even in the 99th percentile, we see a rapid falloff above 100 Mbps. This likely suggests that gigabit plans are not required for the vast majority of subscribers.

The underlying data for this chart includes all technologies for which Preseem collects user data: fixed wireless, cable, DSL, and fiber. Given that the majority of plan speeds greater than 250 Mbps are delivered over fiber, we can see that capacity constraints are a factor in smaller plans but only up to a point. From a consumption perspective, raising plan speeds doesn’t proportionately break the bank in terms of resources consumed.

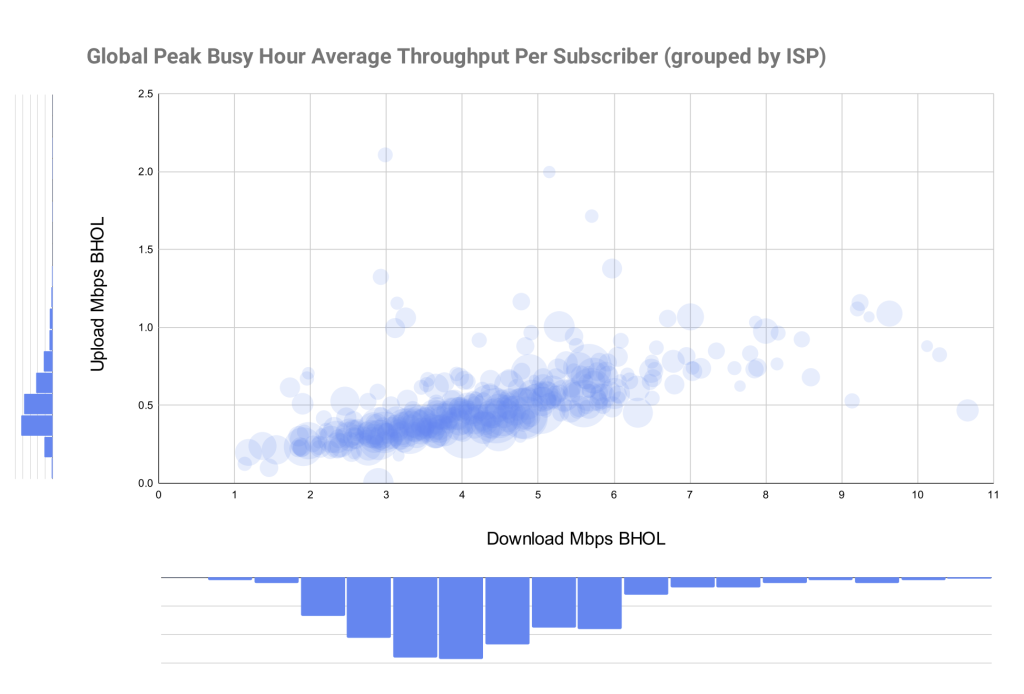

Download to Upload: Peak Busy Hour Ratio

In the previous section, we saw that users are constrained at low plan speeds, but overall download-to-upload usage is remarkably consistent around the globe. 10 download megabits per 1 upload megabit is no longer sufficient upload bandwidth, at least in smaller plans. The FCC recently raised the benchmark for broadband to 100 Mbps/20 Mbps, speeds that will meet the needs of most users. Symmetric plans will help reduce latency under load but are not currently fully utilized, given the high prevalence of streaming video consumption rather than upload.

Busy Hour Online Load (BHOL) is a simple metric defined as the peak ISP usage divided by the number of subscribers (both inactive and active at that moment.)

These trends are useful for planning oversubscription at the core and backhaul level, but are not as useful for planning capacity for “meeting the speed test”. Speed test reliability is typically a function of the most congested point on the network, usually the access point. Most ISPs deliver between 3 and 4 Mbps in the downstream direction (averaged per subscriber) across all technologies, including fiber.

UPDATE: The Fixed Wireless Network Report is now called the ISP Network Report, and the latest edition includes metrics from fiber and hybrid ISPs for the first time. To access all of the charts and exclusive insights from the latest edition, click below to download your free copy.